Disclaimer: I am not a financial advisor or being paid to write this stuff. I do own Ether and BNB.

Is Ethereum vs Binance the big rivalry of the 2020’s? In my day it was Windows vs Apple, where everyone was certain Windows would dominate because of its “open” approach to letting any PC run its software - where Apple took a more “closed” approach. Obviously, both ended up winning in their own game - and innovation changed the narrative any way. Nobody cares about OS anymore.

Is this the same fate of crypto platforms? Or will there be a winner.

At its core, the Binance Smart Chain is an Ethereum copy that is much faster and cheaper than the original - and it's onboarding millions of users at an eye-watering pace. So what is the BSC all about - and what’s to stop it from taking Ethereum’s place?

Here is the growth of Binance Smart Chain (which is also pushing BNB to all time highs as well)

Top 7 Things to Consider

Let’s breakdown the top things to consider:

Binance Smart Chain is new. The Binance Smart Chain was launched by the Binance exchange in September 2020. Ethereum was launched in 2015. Does “age” matter - yes, if you place value on survival and “tested” platforms. But maturity can also mean you take less risk (allowing competition to rise quickly).

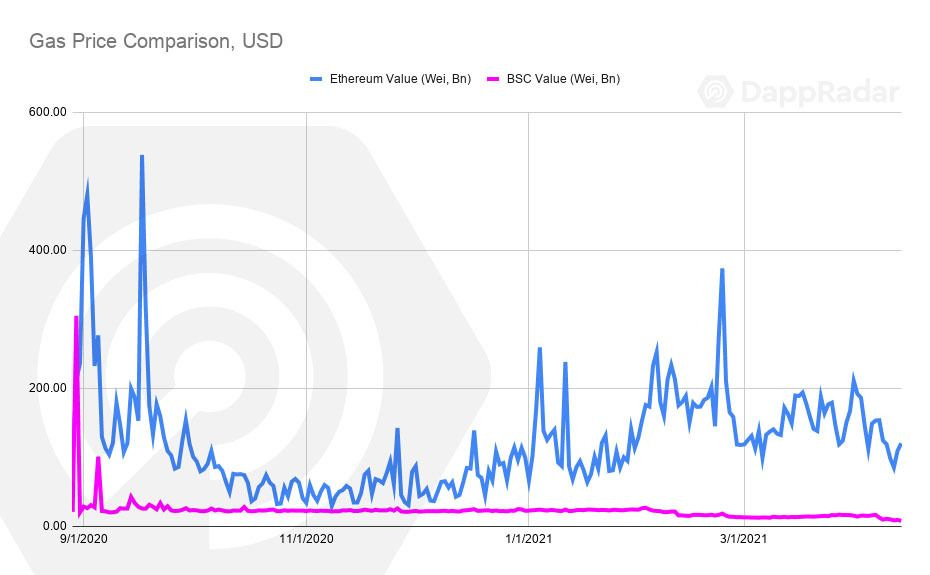

Binance Smart Chain is Cheaper. The pitch of a cheap, fast and nearly identical version of the Ethereum DeFi experience has both developers and users excited. Ethereum is currently rolling our Ethereum 2.0 which should equal the playing field because it is moving to Proof-of-Stake (like BSC did). But until then, BSC gas fees are way lower - which means any new token that wants to launch - will prefer BEP-20 over ETH-20. Gas prices were almost 14 times lower on BSC if compared to Ethereum in 2021 Q1.

Binance Smart Chain is NOT truly Centralized. The term Binance uses is “Centralized DeFi” - which does seem a little contradictory. CeDeFi misses out on true decentralization because the nodes that manage the network are permissioned. Additionally, there is centralized authority, Binance, that manages the direction and operations of the chain. This is important, because Binance is essentially the “Central Bank” of the Binance Smart Chain.

Concern of Censorship. Another issue is censorship resistance, which is the idea that no nation-state, corporation, or third party has the power to control who can transact or store their wealth on the network. Bitcoin and Ethereum aren’t owned by a single entity and the nature of their proof-of-work consensus models means it is very difficult for any single entity to censor transactions. This is not the case with the Binance Smart Chain where Binance technically has the power to censor or modify transactions.

Compatibility. Since the Binance Smart Chain is a fork of Ethereum it uses popular tools like MetaMask that any user who has experimented with Ethereum DeFi in the past is likely to be familiar with. In addition, the BEP20 smart contract standard for issuing new tokens on BSC is similar to the ERC20 smart contract standard that was originally developed for Ethereum. As a fork of Ethereum, the BSC can also run the same smart contracts that Ethereum can. This definitely helps BSC by making it easier for existing Metamask (ERC-20) wallets interface their platform.

BSC Usage topped everyone. BSC is the most used blockchain in terms of unique active wallets averaging 105,000 in March 2021. In less than 6 months, BSC rose from non-existence to the top spot. Of course, you can also see other protocals like Flow and WAX (both I am sure you never heard of) grow just as fast. So one could argue it really wasn’t about how “good BSC was” - but more about how “bad Ethereum Gas Prices are”.

Strength of Development and Validator Community. The Ethereum community is certainly more established than Binance Smart Chain for no other reason that it’s been around a lot longer. But there are reasons the Ethereum community will continue to be stronger - starting with the validators. All network validators on BSC need to be approved by Binance. In addition, the minimum requirements for node operators are set quite high. This goes back to the “centralized” approach. Also, from a development perspective, Ethereum will always be the leader because BSC is a copy of the Ethereum protocol. Therefore, Binance is dependent on Ethereum’s innovation, causing new features to be first rolled-out on Ethereum and only later see their deployment on BSC.

So what does it all mean?

The bottom line is there is always room for two leaders in every category. In fact, it’s almost necessary to ensure there is a fair and healthy market. Coke and Pepsi, Microsoft and Apple, Ford and Chevy - no matter where you look there are always two options.

In the case of Binance vs Ethereum, it comes down to the following

Centralized vs. Decentralized.

Copy vs Original

Cheap vs Cheaper

Only time will tell how long the competitive advantage of being “cheaper” will last - If Ethereum moves quickly to Proof-of-Stake - then Binance Smart Chain will need more than “we are cheaper” to continue to grow. After all, they only innovate if/when Ethereum innovates. Being a copy of something has long term disadvantages.

Of course, everything considered - owning both may be the best bet (but I am not a financial advisor).