Bitcoin is most predictable after a big dump.

Every so often I get a gut feeling about the price of Bitcoin, so I figured I would publish my thoughts on why the best time to buy is after it takes a massive dump. (Not financial advise)

Disclaimer: I am not a financial advisor.

One of the challenges with Bitcoin is understanding what will happen next. There are tons of people that follow different models, and attempt to predict the future price - but rarely do people get it right. Certainly, we all know at some point Bitcoin goes thru mass correction - the problem is we don’t know when. (of course if you simply HODL and never sell - you have no reason to care).

But, for new comers looking to invest in Bitcoin it does matter. It’s always nice to get in at a good entry point. For example, yesterday if you bought at 30k, you would be very happy today - already up 25%.

Stock to Flow Model

The gold standard of predictive models has been the Stock to Flow Model.

This model treats Bitcoin as being comparable to commodities such as gold, silver or platinum. These are known as 'store of value' commodities because they retain value over long time frames due to their relative scarcity. It is difficult to significantly increase their supply i.e. the process of searching for gold and then mining it is expensive and takes time. Bitcoin is similar because it is also scarce. In fact, it is the first-ever scarce digital object to exist. There are a limited number of coins in existence and it will take a lot of electricity and computing effort to mine the 3 million outstanding coins still to be mined, therefore the supply rate is consistently low.

Stock-to-flow ratios are used to evaluate the current stock of a commodity (total amount currently available) against the flow of new production (amount mined that specific year).

The challenge with this model, is that the time frames it follows are relatively long so you won’t get much value if you are looking for what the price may be next week or even next month. This is a long term view, and so far very accurate.

Other Models

There are other crypto analysts that publish their models as well. They look at a range of values and trends that can range from bitcoin dominance, exchange outflow/inflow or even if there is a full moon coming.

Here was a prediction (warning) published on April 16th. by Richard Heart, essentially warning of the big drop we experienced on May 18/19th. You can see Bitcoin falls out of the parabola, and that is typically a sign of hard resistance.

Here is another showing -3.46 sigmas from our 10d trend model. 11 instances historically with 100% hit rate over follow 10-90 days.

Retracing March 2020

I tend to be in the camp that Bitcoin repeats its own history quite a bit. I equate the recent 35%+ dip to the dip we experienced in March 2020. It took about 2 months to fully recover and begin to grow into a bull cycle. When / If we do break thru 50k then one could argue we are on the way for a full recovery within a 60 day time frame.

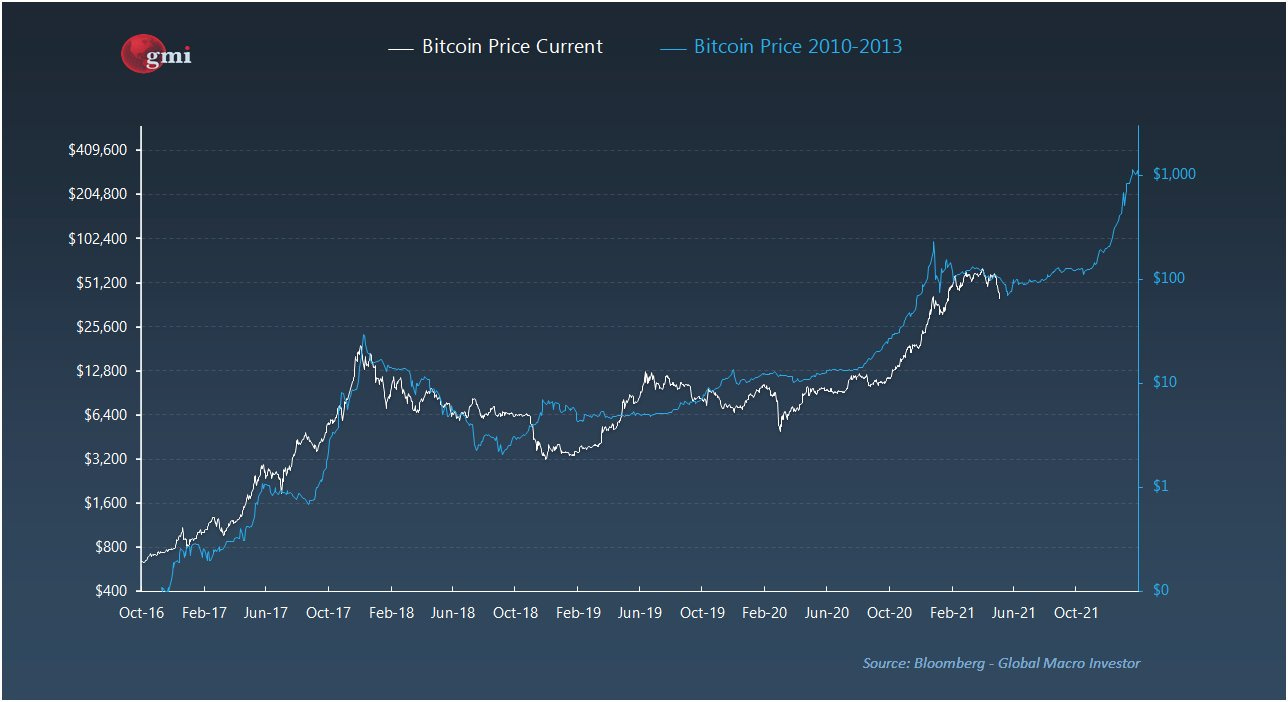

You can see here if you overlay current 2021 chart over 2017 - it’s almost exactly the same.

Here is it 2021 Chart overlay on 2013 chart

Kind of spooky if you ask me.

My Best Guess (For fun of course)

I doodled it below in purple, showing us reaching 60k in July and probably stabilizing in August. The bigger question is what the path of recovery looks like and how it lines up with how the market feels about the bull cycle. Some have predicted it would end in September. Some believe it may evolve into a super cycle.

My take is we will bounce between 40-50k for a while, and then rebuild the 48k support, and bounce a little between 50-60k for the next month or two. The longer we hold over 40k the better.

Fear is the X-Factor

Ultimately, nobody can predict solely based on the charts - because there is always the X factor of fear, uncertainty and doubt created in the news. For the long term holders of Bitcoin this rarely matters, but for short-term holders it definitely leads the way for the bigger dips. In the chart below it shows how Short Term Holders selling at the bottom once we hit a 15-20% dip.

Of course, every time people see it go down and recover (like it did this week) - they become less and less fearful. Eventually, everyone will have diamond hands - and that is what we need if we are going to hit 100k.

If we hold, we win.